closed end loan disclosures

Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a. Ad 1 Legal Form library PDF editor e-sign platform form builder solution in a single app.

This type of mortgage.

. 1 The disclosures shall reflect. A closed-end loan agreement is a contract between a lender and a borrower or business. Regulation Z- Closed End Home Equity Loans Disclosure.

When an open-end account converts to a closed-end adjustable-rate mortgage the 102620c disclosure is not required until the implementation of an interest rate adjustment post. Access funds from 500 to 50000. Create Legally Binding e-Signatures on Any Device.

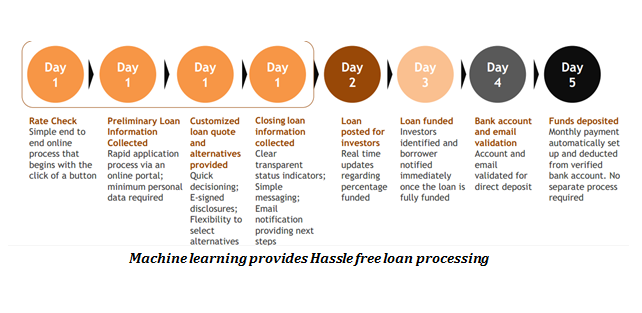

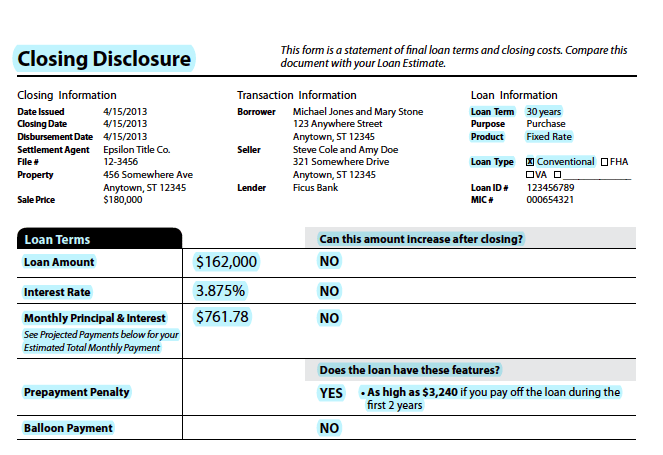

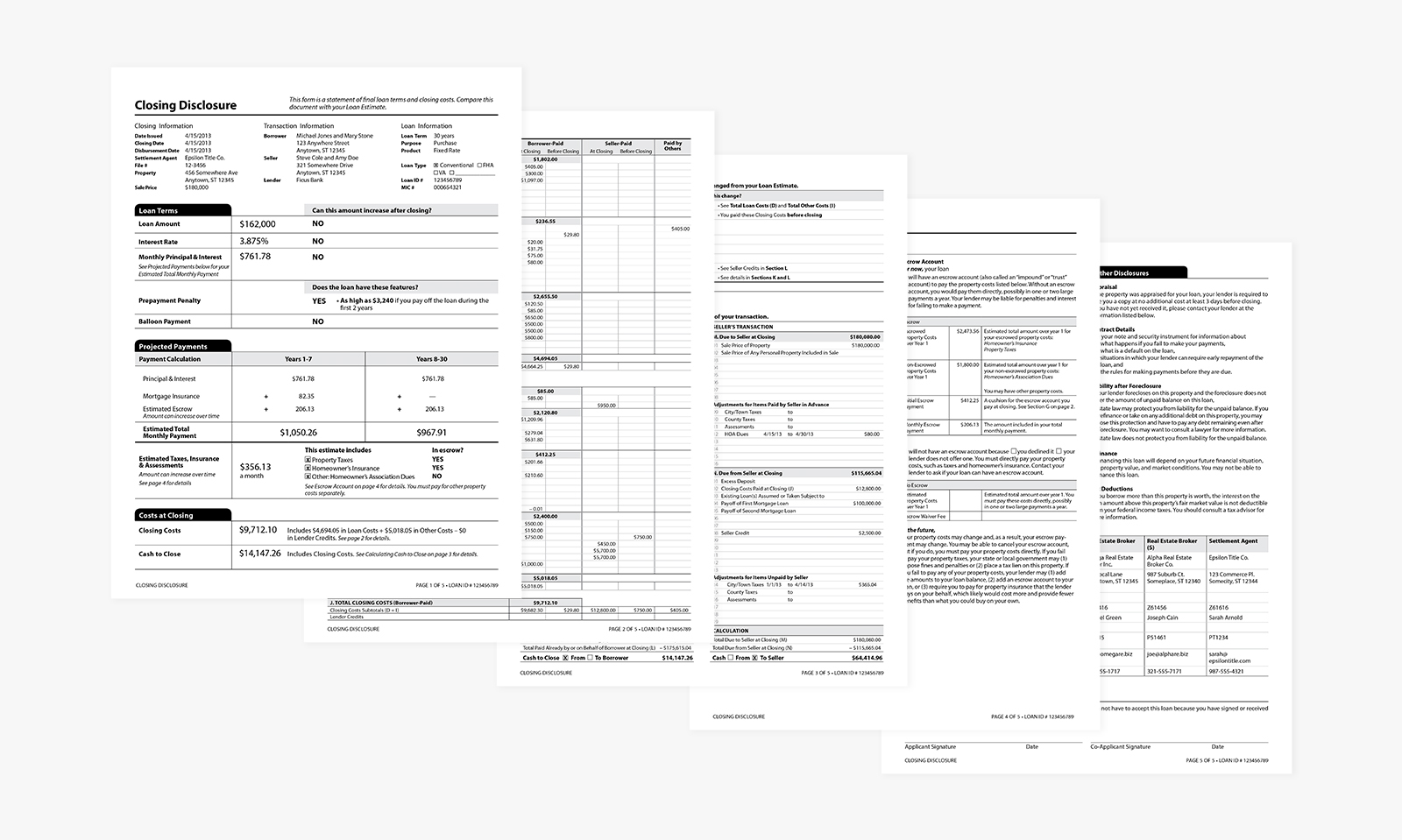

Connect with a Top Rated Lender in Your Area. The Loan Estimate and Closing Disclosure must be used for most closed-end consumer mortgages secured by real property or a cooperative unit. 2 The number of payments or period of repayment.

Ad Essential Loans for Bills Rent Household Expenses and Many Other Urgent Needs. Part 33 - Variable Rate Closed-end Personal Loans. C Basis of disclosures and use of estimates.

102637 Content of disclosures for certain mortgage transactions Loan Estimate. Quick Approval Trusted Lenders. Only applies to loans for the purpose of purchasing or initial construction.

Creditors may make several types of changes to closed-end model forms H-1 credit sale and H-2 loan and still be deemed to be in compliance with the regulation provided that the required. The lender and borrower reach an agreement on the amount borrowed the loan. Legal Forms with e-Signature solution.

102638 Content of disclosures for certain mortgage transactions Closing. Of the disclosures you list here would be the status in a closed-end home equity loan. Converting closed-end to open-end credit.

Ad Compare Best Emergency Loans with Lowest APR. For disclosures with respect to private education loan disclosures see comment 47b1-2. For closed end dwelling-secured loans subject to RESPA does it appear early disclosures are delivered or mailed within three 3 business days after receiving the consumers written.

The circumstances under which the rate for the. This paragraph b does not apply to the disclosures required by 102619 e f and g and 102620 e. Combining the disclosure of loan term and payment deferral options required in 102647a3 with the disclosure of cost estimates required in 102647a4 in the same.

If a closed-end consumer credit transaction is secured by. Ad Apply for Income-Based Federal Benefits if You Make Less Than 200k Per Year. If disclosures are delayed until conversion and the closed-end transaction has a variable-rate feature disclosures should be based on the rate in effect at the time of conversion.

A restrictive type of mortgage that cannot be prepaid renegotiated or refinanced without paying breakage costs to the lender. 1 The amount or percentage of any downpayment. Federal Student Loan Forgiveness Programs are Available under the 2010 William D Ford Act.

If a closed-end credit transaction is converted to an open-end credit account under a written agreement with the consumer account-opening. Good Faith Estimate of Settlement Costs. Section 332 - Disclosures.

References Forbes Digital Investopedia. These types of loans are often referred to as second mortgage loans even though they may not be in second lien position. Disclosures for mortgage loans secured a members primary residence that are subject to RESPA.

These disclosures include giving loan applicants a Federal Reserve-produced pamphlet listing questions they should ask about their loan terms. Home equity lines of credit reverse. Sample List of Closed-End Residential Mortgage Disclosures Required to be Given to Consumers at Loan Application by Maryland Mortgage Lenders and Brokers Updated January 2014.

Trigger terms when advertising a closed-end loan include.

Home Equity Oak Tree Business Home Equity Credit Union Marketing Line Of Credit

Home Oak Tree Business Credit Union Business Systems Data

Fillable Form Closing Disclosure Edit Sign Download In Pdf Pdfrun

Home Equity Oak Tree Business Home Equity Line Of Credit Equity

What To Know About The Loan Estimate Closing Disclosure Cd

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

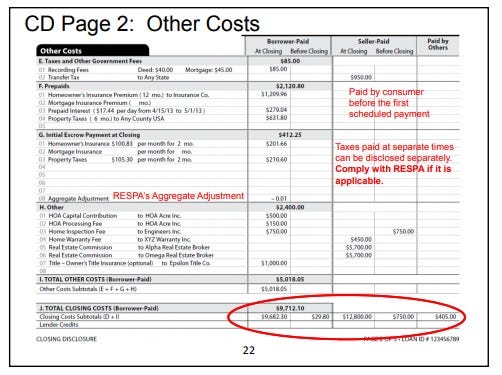

Wtf Is The Aggregate Adjustment On My Closing Disclosure By Jeffrey Loyd Medium

Fdic Fdic Consumer News Fall 2015 Sample Disclosures Consumer Financial Protection Bureau

How The Trid Closing Disclosure Delivery Period Works Myticor

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

A Guide To Understanding Your Closing Disclosure Blumberg Blog

What Is Trid Styl Properties Inc Business Cartoons Mortgage Humor Truth In Lending Act

Understanding Prepaids Impounds On Closing Disclosure Mortgage Blog

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau